CEFA – Certified European Financial Analyst

Kehitä rahoitusalan analyyttistä osaamistasi ja hanki oikeus CEFA-nimikkeeseen

The Certified European Financial Analyst (CEFA) -koulutus on arvostettu Euroopassa tunnustettu tutkinto sijoitus- ja rahoitusalan ammattilaisille, jotka haluavat kehittää, täydentää tai ylläpitää analyysiosaamistaan. CEFA-tutkinnon tarkoituksena on tarjota yhtenäinen ja korkeatasoinen koulutus sijoitus- ja rahoitusalan ammattilaisille.

CEFA – Certified European Financial Analyst -koulutus rakentuu neljästä haastavasta moduulista, joiden aikana katetaan kymmenen alan keskeistä aihepiiriä:

- Financial Accounting and Financial Statement Analysis

- Equity Valuation and Analysis

- Corporate Finance

- Fixed Income Valuation and Analysis

- Economics

- Derivate Valuation and Analysis

- Portfolio Management

- European Regulations

- Ethics

- National Component

Koulutus on suunniteltu suoritettavaksi työn ohessa ja opinnot pystyy sovittamaan hyvin muuhun työaikatauluun. Vaadittava aikainvestointi on noin 225 h, josta 60 % katsotaan teoreettiseksi ja 40 % käytännön harjoitukseksi. Vaadittava opiskelumäärä saattaa kuitenkin vaihdella osallistujan lähtötasosta riippuen.

Koulutuksen järjestää Suomen Sijoitusanalyytikot ry yhteistyökumppaninaan Aalto University Executive Education and Professional Development. Tutkinnon taustaorganisaatio on Euroopan Analyytikkoyhdistysten yhdistys EFFAS (European Federation of Financial Analysts Societies), johon Suomen Sijoitusanalyytikot ry kuuluu. CEFA-kursseja on Suomessa järjestetty yli 20 vuoden ajan ja tutkinnon on suorittanut yli 400 sijoitusalan ammattilaista.

Kaikkien vaadittavien tenttisuoritusten ja vaaditun työkokemuksen jälkeen osallistujat saavat oikeuden käyttää CEFA-nimikettä.

Huomioithan, että tämä ohjelma toteutetaan englanniksi.

Suorittamalla tämän ohjelman olet oikeutettu alumnistatukseen ja pääset osaksi Aalto EE:n maailmanlaajuista alumniverkostoa. Alumniyhteisö tarjoaa arvokkaita etuja, jotka tukevat ammatillista kehittymistäsi ja verkostoitumistasi:

- Kutsuja eksklusiivisiin alumnitilaisuuksiin ja mahdollisuuden verkostoitumiseen muiden alumnien kanssa

- Alumniuutiskirjeen, joka kokoaa yhteen tärkeimmät uutiset, tapahtumat ja sisällöt

- Mahdollisuuden osallistua useimpiin ohjelmiimme alennettuun hintaan

Ohjelman aikana hankit korkeatasoista osaamista sekä ansaitset oikeuden käyttää arvostettua CEFA-nimikettä.

CEFA-koulutusta on järjestetty Suomessa yli 20 vuotta ja tutkinnon on suorittanut yli 400 sijoitusalan ammattilaista.

CEFA-ohjelman suorittamisesta saa 13,5 ECTS-opintopistettä, jotka voi hyödyntää Aalto Executive MBA- ja Aalto MBA -ohjelmissa.

Hyödyt

CEFA-koulutus antaa kattavan ja laaja-alaisen osaamisen tehdä vaativaa analyysityötä. Koulutus tarjoaa uusia teoriaa ja käytäntöä yhdistäviä työkaluja rahoitusalalle ja auttaa varmistamaan työn laatutason tulevaisuudessakin.

Kenelle?

CEFA-koulutus on tarkoitettu sijoitus- ja rahoitusalan ammattilaisille, jotka haluavat kehittää, täydentää tai ylläpitää analyysiosaamistaan.

Tyypillisesti koulutukseen osallistuvat henkilöt työskentelevät arvopaperien ja yritysten analysoinnin, salkunhoidon, arvopaperikaupan, varainhoidon, yritysrahoituksen, riskienhallinnan, taloushallinnon, aktuaaritoimintojen, juridiikan, sijoituksen/rahoituksen järjestelmäkehityksen tai sijoittajaviestinnän tehtävissä.

Sisältö ja aikataulu

CEFA-ohjelma koostuu neljästä moduulista, joissa on yhteensä yhdeksän lähiopetuspäivää. Moduulit on rakennettu EFFAS:n vaatimusten mukaisesti. Kolme ensimmäistä moduulia sisältää ennakkomateriaaleja, kolme koulutuspäivää sekä itsenäistä opiskelua. Viimeinen, neljäs moduuli toteutetaan kokonaan itseopiskeluna.

CEFA -ohjelman suorittamisesta saa 13,5 ECTS-opintopistettä, jotka voi hyödyntää Aalto Executive MBA- ja Aalto MBA -ohjelmissa.

Katso tarkempi sisältö ja aikataulu englanninkieliseltä sivulta.

Ohjelman rakenne

Lähiopetukseen valmistautuminen

Itsenäistä valmistautumista sekä ennakkomateriaaleihin tutustumista

Kolmepäiväinen lähiopetusmoduuli

Intensiivistä lähiopetusta Aalto EE:n ja Aalto yliopiston professorien johdolla

Tenttiin valmistautuminen

Neljä viikkoa itsenäistä valmistautumista ja opiskelua tenttiin

Koulutusjaksot

Kouluttajat

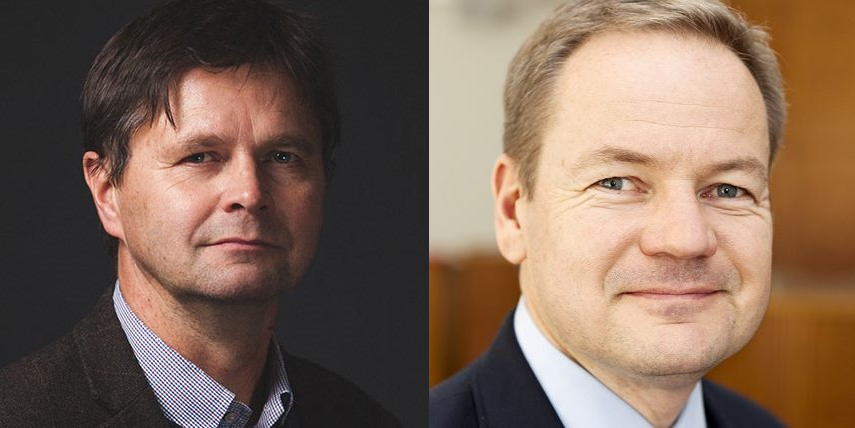

Markku Kaustia

Markku Kaustia on rahoituksen Hannes Gebhard -professori Aalto-yliopiston kauppakorkeakoulussa.

Hän on aiemmin työskennellyt Michiganin yliopistossa ja Whartonin kauppakorkeakoulussa, sekä opettanut myös Columbia yliopistossa New Yorkissa. Aallossa hän on toiminut rahoituksen laitoksen johtajana sekä rahoituksen maisteri- ja kandiohjelmien johtajana.

Kaustian osaamisaluetta ovat rahoitusmarkkinat, niiden toimijat ja instituutiot. Hänen tutkimustaan on julkaistu taloustieteen arvostetuimmissa tiedejulkaisuissa (esim. Journal of Finance, Journal of Financial Economics, Management Science). Kaustia opettaa rahoitusta kandi-, maisteri-, MBA- ja tohtoriohjelmissa Aallossa ja muualla, sekä puhuu rahoitusalan seminaareissa. Hänet on palkittu mm. Aalto-yliopiston kauppakorkeakoulun parhaana opettajana.

Kaustia toimi kahden vuoden ajan EU komission sijoitustuotteiden riskiluokitteluun liittyvässä asiantuntijaryhmässä sekä konsultoi eduskunnan talousvaliokuntaa EU:n vihreää sijoittamista koskevasta regulaatiosta. Viime vuosina Kaustian tutkimus ja opetus ovat suuntautuneet kestävään rahoituksen, erityisesti ilmaston muutokseen ja yritysten yhteiskunnalliseen vaikuttamiseen.

Niku Määttänen

Niku Määttänen on makrotaloustieteen professori Helsingin yliopistossa ja Aalto-yliopiston kauppakorkeakoulussa.

Hänen tutkimusintressejään ovat muun muassa julkinen talous, asuntomarkkinat ja makrotaloustiede. Hänen opetusalueitaan ovat makrotaloustieteen numeeriset menetelmät taloustieteessä. Hänen akateemisia artikkeleitaan on julkaistu tunnetuissa lehdissä, kuten Journal of Economic Theory ja Review of Economic Dynamics.

Ennen siirtymistään Helsingin yliopistoon elokuussa 2020 hän toimi tutkimusjohtajana Elinkeinoelämän tutkimuslaitoksessa. Hän on myös opettanut Aalto-yliopistossa ja Helsingin yliopistossa useita vuosia.

Niku Määttäsellä on kauppatieteiden tohtorin tutkinto Pompeu Fabran yliopistosta Barcelonasta, kauppatieteiden maisteri Pompeu Fabran yliopistosta ja diplomi-insinööri Helsingin yliopistosta Suomesta.

Elias Rantapuska

Elias Rantapuska toimii Aalto-yliopiston kauppakorkeakoulun rahoituksen apulaisprofessorina ja laitoksen johtajana ja vierailee tällä hetkellä Rotterdamin Erasmus University Rotterdamissa, Rotterdamin johtamiskorkeakoulussa.

Hänen nykyiset akateemiset tutkimuskohteensa sisältävät aiheita, kuten tunteiden rooli, kokemukset, ja perhesuhteet sijoituspäätöksissä.

Hänellä on tohtorintutkinto kauppatieteistä Helsingin kauppakorkeakoulusta. Ennen Aalto-yliopistoon siirtymistään Rantapuska on työskennellyt Nordean, J.P. Morganin ja McKinsey & Companyn palveluksessa. Aalto-yliopistoon 2010 tultuaan Rantapuska on työskennellyt vierailevana tutkijana ja professorina Bank of Finlandissa, BI Norwegian Business Schoolissa, HKUSTissa, NYU:ssa ja SSE:ssä.

Matthijs Lof

Matthijs Lof on rahoituksen apulaisprofessori Aalto-yliopiston kauppakorkeakoulussa. Hän on koulutukseltaan kauppatieteiden tohtori Helsingin yliopistosta ja ekonometrian maisteri Amsterdamin yliopistosta.

Ennen Aaltoon tuloaan Lof on työskennellyt Euroopan keskuspankissa ja Hollannin keskuspankissa.

Hänen tutkimuskohteitaan ovat omaisuuserien hinnoittelu, rahoitusmarkkinat ja sijoittajien käyttäytyminen. Hänen työnsä on julkaistu johtavissa aikakauslehdissä, kuten Management Science, Journal of Economic Dynamics and Control ja Journal of Corporate Finance.

Antti Suhonen

Antti Suhonen työskentelee työelämäprofessorina (Professor of Practice) Aalto-yliopiston kauppakorkeakoulun rahoituksen laitoksella.

Hän opettaa rahoituksen korko- ja velkakirjamarkkinoita käsittelevää kurssia “Fixed Income”, ja hänen tutkimusalueitaan ovat mm. vaihtoehtoiset sijoitukset, finanssi-instituutiot sekä korko- ja lainamarkkinat.

Lisäksi hän työskentelee konsulttina ja neuvonantajana finanssialalla keskittyen rahoitus- ja johdannaismarkkinoihin sekä vaihtoehtoisiin sijoituksiin. Hän toimii myös finanssialan kouluttajana.

Aiemmin Suhonen on työskennellyt johtajana (Managing Director) Barclays Capital –investointipankissa Lontoossa, sekä muissa pankkialan asiantuntija- ja johtotehtävissä vuosina 1993-2013.

Antti Suhonen on suorittanut kauppatieteiden tohtorin ja kauppatieteiden maisterin tutkinnot Helsingin kauppakorkeakoulussa.

Michael Ungeheuer

Michael Ungeheuer on rahoituksen apulaisprofessori Aalto-yliopiston kauppakorkeakoulun rahoituksen laitoksella.

Hänen tutkimuskohteitaan ovat sijoittajien käyttäytyminen, omaisuuden hinnoittelu ja kotitalouksien rahoitus. Opetusalueita ovat Capstone Valuation, Corporate Finance, Johdannaiset, Kansainvälinen varainhoito, Sijoitukset ja omaisuuden hinnoittelu ja riskienhallinta.

Hän on ollut Aalto-yliopiston kauppakorkeakoulussa, rahoituksen laitoksella vuodesta 2017. Ennen Aalto-yliopistoon siirtymistään hän on ollut tutkimus- ja opetusassistentti Mannheimin yliopistossa Saksassa.

Michael Ungeheuer on suorittanut tohtorin tutkinnon rahoituksen alalta Saksan Mannheimin yliopistosta, taloustieteen maisteritutkinnon Illinoisin teknillisestä instituutista Yhdysvalloista ja Diplom Business Economics Mannheimin yliopistosta Saksasta.

Luettavaa aiheesta