CEFA – Certified European Financial Analyst

Improve Your Financial and Analytical Competence and Become a CEFA Holder

The Certified European Financial Analyst (CEFA) program offers uniform, high-level, standardized training for investment and finance professionals, culminating in the highly respected CEFA qualification, which is accredited in 27 European countries. The program offers a valuable opportunity for all investment and financial professionals seeking to develop, supplement, or enhance their analytical skills.

The CEFA syllabus covers ten key topic areas that together enable participants to face the emerging challenges of the profession:

- Financial Accounting and Financial Statement Analysis

- Equity Valuation and Analysis

- Corporate Finance

- Fixed Income Valuation and Analysis

- Economics

- Derivative Valuation and Analysis

- Portfolio Management

- European Regulations

- Ethics

- National Component

The CEFA program is designed to be completed alongside work, and the studies can easily fit into the rest of the work schedule. The time investment required is approximately 225 h, of which 60% is considered theoretical and 40% a practical exercise. However, the required number of studies may vary depending on the participant's starting level.

The program is organized by the Finnish Association of Financial Analysts in cooperation with Aalto University Executive Education Ltd. The umbrella organization for the CEFA program is the European Association of Financial Analysts (EFFAS). CEFA programs have been organized in Finland for more than 20 years and have been completed by more than 400 investment professionals.

Participants who pass all the required examinations and have the required work experience will be entitled to use the CEFA title.

By completing this program, you will be eligible for alumni status and become part of Aalto EE's global alumni community. The alumni community offers valuable benefits that support your professional development and networking:

- Invitations to exclusive alumni events and networking opportunities

- An alumni newsletter that brings together the most important news, events, and content

- The opportunity to participate in most of our programs at a special fee

The program provides you with uniform high-level competencies and entitles you to use the well-known CEFA title.

CEFA programs have been organized in Finland for more than 20 years and have been completed by more than 400 investment professionals.

Completing the CEFA program will earn you 13.5 ECTS credits towards the Aalto Executive MBA or Aalto MBA program.

Benefits

The CEFA program gives you comprehensive and extensive competencies to perform demanding analytical work. The program offers new tools to the financial sector for combining theory and practice and helps ensure the quality of future work.

For

The CEFA program is designed for investment and financial professionals who wish to develop, supplement, or maintain their analytical skills.

The program is particularly aimed at experts involved in financial analysis, asset management, pension funds, life insurance, wealth management, financial research, corporate finance, financial journalism, and financial legislation/regulation.

Contents and Schedule

The CEFA program consists of four modules with a total of nine training days. The modules are structured according to EFFAS requirements. Each of the first three modules includes pre-readings, three training days, and self-study. The fourth module is implemented as independent study.

13,5 ECTS credits can be transferred from this program to the Aalto Executive MBA or Aalto MBA program.

Program Structure

Pre-module period

Individual preparation and pre-readings

Three-day modules

Intensive face-to-face sessions with Aalto EE and Aalto University instructors

Post-module period of 4 weeks

Individual preparation and study for exam

Modules and Examination Days

Instructors

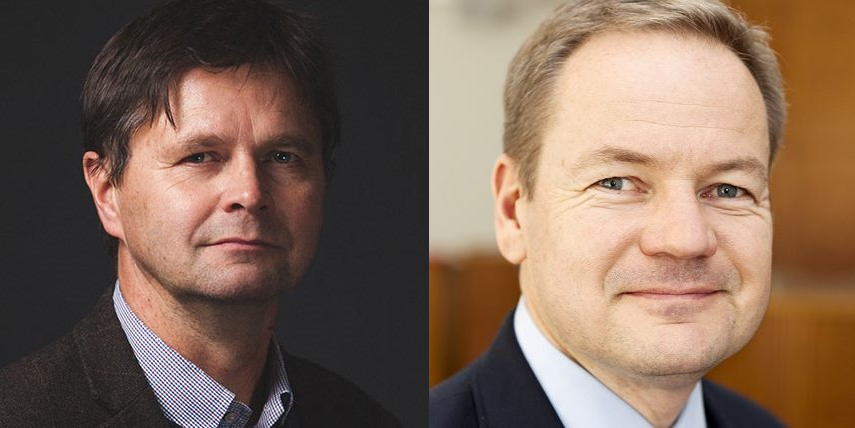

Markku Kaustia

Markku Kaustia is the Hannes Gebhard Professor in Finance and Insurance at Aalto University School of Business.

His areas of research include finance, investments, financial markets, assets management, investor behavior, and psychology. His research has been published in leading academic journals, like the Journal of Banking and Finance, Journal of Financial Economics, and Journal of Finance.

Professor Kaustia is a regular speaker and teacher for finance professionals and conferences. He has investigated micro-foundations of investment epidemics, dynamics of investors' risk aversion, and behavioral biases of finance professionals.

He has been at Aalto University, School of Business, Department of Finance, since 2008. As a Visiting Professor, he has taught in the USA at the University of Michigan, Ross School of Business (2011-2012), and at the University of Pennsylvania, Wharton School of Business (2012-2013).

In 2014, Aalto University established the position of Hannes Gebhard Professor in Finance & Insurance to acknowledge the support of the OP-Pohjola Group in promoting scientific research in finance. Hannes Gebhard was a Finnish businessman, professor of economic history & economics, member of Parliament & father of the Finnish Cooperative Business.

Markku Kaustia has a Ph.D. in Finance from Aalto University School of Business.

Niku Määttänen

Dr. Niku Määttänen is professor of macroeconomics at the University of Helsinki and Helsinki Graduate School of Economics in Helsinki, Finland.

His research interests include Public finance, Housing Markets and Makroeconomics. His areas of teaching are Macroeconomics numerical methods in Economics. His academic articles have been published in well-recognized journals such as Journal of Economic Theory and Review of Economic Dynamics.

Prior to joining University of Helsinki in August 2020, he was a research director at the Research Institute of the Finnish Economy. He has also been teaching at Aalto University and University of Helsinki for several years.

Niku Määttänen has a Ph.D. in Economics from University of Pompeu Fabra, Barcelona, M.Sc. in Economics from University of Pompeu Fabra, and M.Sc. from University of Helsinki, Finland.

Elias Rantapuska

Dr. Elias Rantapuska is an Associate Professor of Finance and Department chair at Aalto University School of Business Department of Finance and currently visiting Erasmus University Rotterdam, Rotterdam School of Management.

He holds D.Sc. (Econ.) from Helsinki School of Economics. Prior to joining Aalto University, Elias worked for Nordea, J.P. Morgan, and McKinsey & Company. After joining Aalto University in 2010, Elias has worked as a visiting scholar and professor at Bank of Finland, BI Norwegian Business School, HKUST, NYU, and SSE. He also frequently engages with practitioners through consulting engagements.

His current academic research interests include topics such as the role of feelings, experiences, and family relationships in investment decisions.

Matthijs Lof

Matthijs Lof is an Associate Professor of Finance at Aalto University School of Business.

He has a PhD in Economics from the University of Helsinki and an MSc in Econometrics from the University of Amsterdam. Prior to joining Aalto, he had worked at the European Central Bank and the Dutch Central Bank.

His research interests include asset pricing, financial markets, and investor behavior. His work is published in leading journals including Management Science, the Journal of Economic Dynamics and Control, and the Journal of Corporate Finance.

Antti Suhonen

Antti Suhonen is a Professor of Practice in Finance at Aalto University School of Business.

He also works as a consultant and adviser to clients in the financial services sector, focusing on financial markets, derivatives, and alternative investments. His teaching and research interests include alternative investments, financial institutions, and fixed-income and credit markets. He is also engaged in financial training for professional audiences.

He previously held various derivatives structuring, product development, sales, and trading roles in investment banking over two decades, most recently as Managing Director at Barclays Capital in London.

Antti Suhonen holds an M.Sc. (Economics) and a Ph.D. (Finance) from Helsinki School of Economics and Business Administration.

Michael Ungeheuer

Dr. Michael Ungeheuer is an Assistant Professor of Finance at Aalto University School of Business Department of Finance. His research interests include Investor Behavior, Asset Pricing, and Household Finance.

Teaching areas are Capstone Valuation, Corporate Finance, Derivatives, International Asset Management, Investments and Asset Pricing, and Risk Management.

He has been at Aalto University, School of Business, Department of Finance, since 2017. Prior to joining Aalto University, he has been Research and Teaching Assistant in the University of Mannheim, Germany.

Michael Ungeheuer has a Ph.D. in Finance from the University of Mannheim, Germany, M.Sc. in Finance from Illinois Institute of Technology, USA, and a Diplom Business Economics from the University of Mannheim, Germany.

Featured Insights